VIDEO: Show VAT on invoice

Not every self-employed person is allowed to show VAT

- If you have started your own business, you may, under certain circumstances, rely on your bills also show the VAT. However, this is only possible if you do not make use of the small business regulation.

- If you are a small business owner, you are not allowed to show VAT, nor do you get a refund of the input tax for business-related purchases from the tax office.

- Tax processing is a bit of a hassle, but it is an advantage for most companies. This is especially true if you have to make a lot of purchases. For this reason, find out very carefully whether it makes sense for you to take advantage of the small business regulation.

- With any other form of self-employment, you have tax obligations towards the responsible tax office. You have to show the VAT in a separate field on each individual invoice and regularly pay this portion to the tax office. If you are a freelancer, you even have to submit a monthly tax report to the tax office.

This is how VAT works on invoices

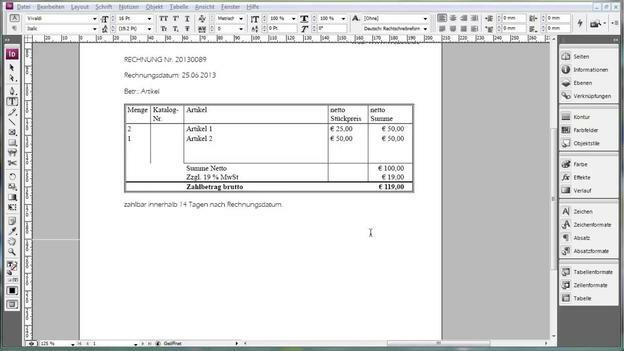

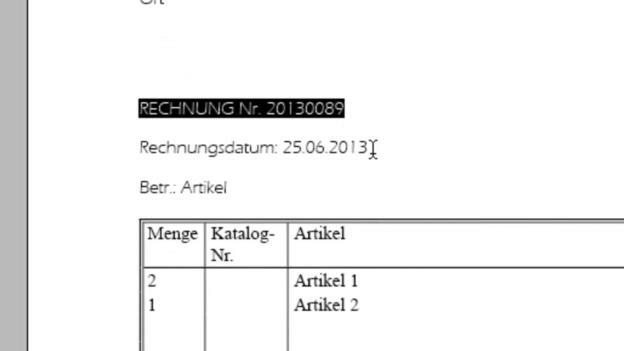

An invoice on which the VAT is shown must be drawn up in Germany according to a certain model. Every invoice of this type must show three different amounts.

What must be on an invoice? - That’s how it’s going to be correct

An invoice is a formality to be taken seriously. Make in the formulation ...

- First, calculate the net amount for your services or products that you want to bill a customer. The respective VAT must be added directly below in the next line. Depending on the product, this is either 7 or 19 percent.

- Multiply the net amount on the invoice by 1.07 or 1.19 and you get the gross amount. Subtract your net amount from the gross amount and you will get the amount of VAT.

- Write this value under the field of the invoice amount and note the total amount (gross amount) of your invoice in the last field.

If the invoice recipient is also a company, he will receive from Tax office the VAT will be reimbursed by the tax office. Private individuals are of course not entitled to do so and have to pay the full gross amount.