"Incl. VAT "

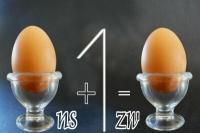

If you as an entrepreneur make an offer or write an invoice, you usually have to show the value added tax or the price "incl. VAT ". Especially when preparing an offer, you should make sure that the end user is aware of the VAT.

When you're not Small business owner and indicate on your invoices that you therefore do not have to pay any VAT or If you collect sales tax, you as an entrepreneur must indicate the value added tax when quoting the price. Whether you choose the price "incl. VAT ", or whether you indicate the net price and then point out that this includes VAT, is up to you.

For an offer the price "incl. VAT "

- Whether you, as an entrepreneur, directly "incl. VAT ", or just adding a reference to VAT to the net price, can have very different psychological effects.

- If you state the gross price, it will of course be higher than the net price. For a private end consumer, for whom the sales tax is not just a "pass-through item" as it is for an entrepreneur, you can look expensive.

- However, only enter the net price and the offer will only be found somewhere "hidden" somewhere Note that all prices are exclusive of the statutory value added tax, which could not be very appealing works.

- In the worst case, a private end user overlooks this notice and is then amazed at the high bill. Then you might have won him over as a customer, but he may now think you are someone who does not clearly state how much his services "cost" and therefore appear dishonest. You risk at least a recommendation.

- Enter the price in an offer "incl. VAT ", then the private consumer knows immediately what he will have to pay in the end.

A new car or a fancy company car is something special that you ...

Include the applicable VAT on an invoice

- In the case of an invoice, you, as an entrepreneur, must pay the added value or Show sales tax separately.

- Here it must be clearly recognizable what the fee for your services or the price of your products and what amount is due as VAT.

- This also includes specifying the applicable VAT rate, because not every service is subject, for example, to a 19% sales tax.

Whether you, as an entrepreneur, include the price "incl. VAT ", or just indicate the net price together with a reference to VAT, can have different psychological effects.