Convert the pension present value to n in advance

The pension cash value in advance is calculated within financial mathematics. You can convert the formula required for this after n in order to determine the period of the pension payment.

What you need:

- calculator

Calculate the pension present value in advance

- In financial mathematics, you understand pensions to mean all periodic cash benefits in equal amounts. In contrast, life annuities are treated in actuarial mathematics.

- Please note that you are talking about an additional pension if the pension payments are due at the end of a period, for example a year. On the other hand, a pension is called in advance if the due date is at the beginning of the period.

- Would you like to advance R0 calculate, you mean by it the sum of all discounted annuity installments r with a certain interest rate p for the annuity period n. The calculated amount therefore relates to the beginning of the first year of payment.

- The formula for the advance cash value is R.0 = r * q (qn - 1) / qn (q - 1). You can now move it to n.

Convert the formula from the present value to n

- It is not difficult for you to convert the formula for the pension present value in advance to n, since you can do this by means of an equivalence conversion. In the first step, R0 = r * q (qn - 1) / qn (q - 1) << >> R0 / r = q (qn - 1) / qn (q - 1).

- In order to calculate n it is now necessary that you rearrange the equation so that qn on one side it says: R0 / r * q - 1 / q = 1 - 1 / qn << >> 1 / qn = 1 - R0 / r * q - 1 / q << >> qn = 1/1 - R0 / r * q - 1 / q.

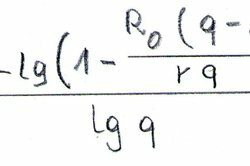

- Since n is the power of q, the last thing you need to do is log the equation: n = [- lg (1 - R0 (q - 1) / r * q] / lg q.

- As an exercise, determine the pension period if a bank customer has a capital of € 43,258.76, which is 6% p. a. interest is paid, invested and then withdraws € 6,000 at the beginning of a year until the capital is used up: n = - lg [1 - 42,258.76 * 0.06 / 6.360] / lg 1.06 << >> n = - lg 0.59189 / lg 1.06 = 0.22776 / 0.025306 = 9.

- The result is that the bank customer can withdraw 6,000 euros for 9 years. With the calculator the calculation is not difficult.

Final pension value and present value - the difference

The difference between the final pension value and the present pension value lies in the calculation, because ...

How helpful do you find this article?